The key focus of F&A Next 2022 was on transforming global food systems. One solution that is not unheard of, seems to lie in alternative proteins. These substitutes for traditional proteins are acknowledged as imperative for our current and, more importantly, future food system. PeakBridge VC, event partner of F&A Next, saw the rise of a movement in Mycelium and performed a deep dive on the space in support of our investment decisions. They are happy to share this interesting analysis with the F&A Next audience.

As FoodTech-focused investors, we at PeakBridge are constantly exposed to emerging FoodTech trends. First, we see an increase in the pool of startups being analyzed in a particular space, followed by specific interest raised by our investors and collaborators, key global players in the food industry, and lastly — the trend is adopted by the entire FoodTech ecosystem around us. In the case of Mycelium, given the trend’s fit with our investment strategy, we performed a “deep dive” on the space in support of our investment decisions. We thought this would be interesting to others and wanted to share.

The basics: fungi, mycelium, mushroom, what’s the deal here?

To understand why the interest in mycelium as an alternative protein source is on the rise, let’s start with some key definitions. FUNGI are a separate life Kingdom, meaning fungi species are distinct from both animals and bacteria, forming their own evolutionary branch in the tree of life owing to distinguishing properties. There are over 150,000 types of fungi, some of them are the ones you don’t want to find on your feet… others are called yeast, rust, or even live within plants.

Amongst other things, what’s common to most fungi is that the main body is formed by thin strands of cells called HYPHAE, that branch together below the surface to form a massive network of cells, called MYCELIUM. The

MUSHROOM, on the other hand, is a fruiting part that grows above ground and is the reproductive structure produced by some fungi.

Mycelium has a history within the food industry

Mycelium and the food industry go way back. OK, not way back, but it is definitely not as new as other current food trends. The brand Quorn is well recognized as the pioneer in the field, as the first company introducing a MYCOPROTEIN, i.e. mycelium-based protein products to the market, on the market in the mid 1980’s following a development effort that started in the 60’s.

Marlow Food, which originally developed and commercialized Quorn, paved the way to adopt mycelium as a food component through precise strain selection (out of 3,000 screened organisms), a proprietary industrial-scale process development, and successfully obtaining regulatory approval (which took 10 years!). The company was purchased by Monde Nissin, a Philippines-based company, for GBP 550 million (USD 831 million) in 2015. Quorn is sold today in 15 countries, with 620 employees at three sites.

The why, what, and how

-

The Why

Consulting with experts in the space, we quickly understood that mycelium possesses a combination of attributes that makes it an attractive alternative protein source from an industry perspective. This includes the following:

FUNCTIONALITY

- Taste: claimed as neutral, compared to plant-based protein.

- Texture: meaty-like, derived from mass of branching, thread-like hyphae structures.

NUTRITIONAL COMPOSITION

- High content & quality of protein: contains all 9 essential amino acids, high bioavailability.

- High fiber, vitamins, and nutrient content.

- Low cholesterol & saturated fats.

PRODUCTION SCALABILITY

Fermentation-based production supports high scale: e.g., Quorn’s mycoprotein is brewed in 150,000-liter fermenters.

SUPPORTING EVIDENCE FOR HEALTH BENEFITS

Literature studies have indicated a positive impact of mycelium on blood lipids, insulin, glucose, cholesterol, promotion of muscle synthesis, and satiety.

SUPPORTING EVIDENCE FOR SUSTAINABILITY

Studies show that production could offer advantages in terms of carbon emissions, land and water use, both as compared to “traditional” meat sources and plant-based protein sources. Keeping this in mind, you are probably asking yourselves Why now? We did.

Looking at the technological aspects, advances are constantly being achieved in enabling technologies, such as fermentation and functional genomics, that allow for identifying and/or improving fungi strains. These might be considered as contributors to the mycelium-as-food emerging trend, however, there has not been a significant breakthrough that would account for such an increase in interest. In this case, the market is the key driver. The time is just right. Alternative proteins are acknowledged as imperative for our current and, more importantly, future food system. Plant-based sources are used and explored by many players, both traditional and innovative, and the cultivated meat option is not yet within reach.

So, the race is on for bringing the next exciting protein, hopefully, with the ability to complement what we have learned from the current generation of alternative proteins. The enormous, relatively untapped mycelium space has the promise to offer just that: a new source of alternative protein with advantages relating to taste, texture, and nutritional value, all in a sustainable manner. And with consumers seeking all-natural and sustainable products, mycelium is certainly appealing.

-

The What

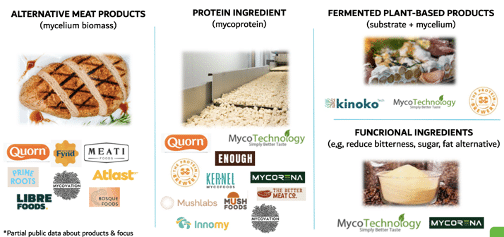

Going back to the appealing attributes described above, these allow for DIVERSE PRODUCT APPLICATIONS including using mycelium to produce:

- A protein ingredient (i.e. mycoprotein powder)

- Alternative meat products like nuggets, bacon, and chicken breast

- Fermented plant-based products, which are hybrids of plant substrates and mycelium

- Functional ingredients, e.g. bitterness reduction, sugar, and fat alternatives.

-

The How

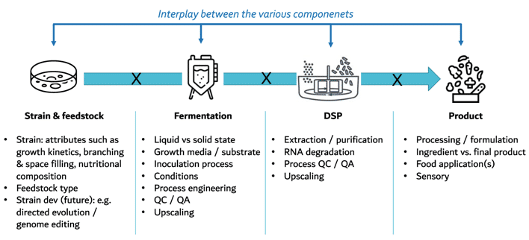

Without diving too deep into the underlying technologies, any mycelium-based product is a combination of selected strain, its feedstock, the fermentation approach and conditions, and product-specific down-stream processes. For each, there are multiple considerations and parameters that can be selected or optimized, as well as the interplay between them — to impact key aspects like product taste, quality, cost, and scalability. Innovation in this space can stem from every choice made in each of these components. Take strain selection as an example. These vary widely in attributes ranging from growth rate to nutritional composition. Keeping in mind that strains which are new to the food industry will need to pass through regulatory approval before they can be sold as a product.

Strain selection is also directly linked to feedstock, a parameter critical for growth rate of the strain, the quality of the output as well as process costs. In addition, using industry-side streams as feedstock has clear advantages and is gaining popularity. Another example is the type of process. Fermentation can be performed via liquid (or submerged) or solid-state, which vary in terms of various aspects, e.g. operational costs, CAPEX, process control and scalability. Finally, the down-stream processes to lead to the chosen product is another key component that impacts sensory and quality outcomes, together with production scalability and costs.

The innovation race: landscape, runners up, and what’s next

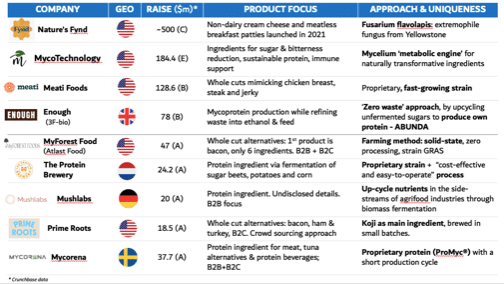

The mycelium innovation space is booming, and if you got to read up to this point, we certainly hope you understand why. Many innovative players are out there — for a complete space review, we recommend the Fungi Database by FoodHack, which maps the key players. See a list of potential “runners up” is in the table below, comprising the companies most advanced in funding to date:

The wonderful, extremely diverse fungi Kingdom holds great opportunities for the FoodTech sector. Mycelium has re-emerged as a promising alternative protein source, with broad, untapped potential. Our point of view is that key innovation enablers include strain & feedstock diversity, process innovation, and functional ingredient applications. As the timing is no doubt right, mycelium can win over consumers with taste, nutritional, functional, scalable, and impact-related benefits.

About the author: Maya Schushan Orgad serves as CTO of PeakBridge and is leading its technological investing. Prior to joining PeakBridge, Maya was a VP at Bayer Trendlines Ag Innovation Fund, Trendlines Agrifood. Before that, Maya led entry strategy and expansion at Evogene, a leading, publicly traded biotech company involved in Agtech, in which she served as director of business development. Maya holds a PhD in computational biology from the Biochemistry & Molecular Biology Department at the Life Sciences Faculty of Tel Aviv University.